Financial intelligence is often associated with budgeting, investing, and managing debt, but one of its most overlooked expressions is the strategic use of insurance. At its essence, financial intelligence is the ability to make informed decisions that protect and grow one’s financial well-being. Insurance fits squarely within this framework. It’s not just a safety net—it’s a proactive tool that reflects foresight, discipline, and a deep understanding of risk. When individuals and businesses incorporate insurance into their financial strategy, they demonstrate a level of sophistication that goes beyond simple asset accumulation. They’re thinking about sustainability, resilience, and long-term security.

Understanding insurance as a form of financial intelligence begins with recognizing its role in risk management. Every financial plan, no matter how robust, is vulnerable to unexpected events. Illness, accidents, natural disasters, and market disruptions can derail even the most carefully laid plans. Insurance doesn’t eliminate these risks, but it mitigates their impact. It allows individuals and organizations to absorb shocks without compromising their financial stability. For example, a small business owner who invests in liability and property insurance isn’t just complying with regulations—they’re protecting their cash flow, their reputation, and their ability to operate under adverse conditions. That’s not just smart—it’s strategic.

The decision to purchase insurance also reflects a nuanced understanding of opportunity cost. Money spent on premiums could be used elsewhere, but the potential cost of being uninsured is often far greater. Financially intelligent individuals weigh these trade-offs carefully. They understand that insurance is not an expense to be minimized, but an investment in continuity. This mindset is particularly important in high-risk environments, where the cost of disruption can be catastrophic. A family that chooses comprehensive health coverage, for instance, may pay more upfront, but they gain access to preventive care, timely treatment, and peace of mind. These benefits translate into better outcomes and lower long-term costs.

Insurance also supports financial intelligence by enabling better planning. When risks are covered, individuals and businesses can make decisions with greater confidence. They can invest, expand, and innovate without the constant fear of loss. This freedom is essential in today’s fast-paced economy, where agility and boldness often determine success. Entrepreneurs, for example, rely on insurance to protect their ventures during critical growth phases. Without it, a single setback could wipe out years of effort. With it, they can focus on building value, knowing that their downside is managed. This kind of calculated risk-taking is a hallmark of financial intelligence.

Moreover, insurance encourages a holistic view of financial health. It prompts individuals to consider not just their assets, but their vulnerabilities. It asks questions that are central to financial literacy: What are my risks? How can I protect my income? What happens if I’m unable to work? These questions lead to deeper engagement with financial planning and foster a mindset of responsibility. In business, this translates into integrated risk assessments and contingency planning. Companies that embed insurance into their financial strategy are better prepared for volatility and more resilient in the face of change.

The role of insurance in financial intelligence is also evident in its alignment with long-term goals. Retirement planning, estate management, and wealth transfer all involve insurance in some form. Life insurance, for example, ensures that dependents are cared for, debts are settled, and legacies are preserved. Disability insurance protects income streams and supports financial independence. These products are not just about protection—they’re about intention. They reflect a desire to plan for the future, to safeguard loved ones, and to maintain dignity in the face of adversity. That kind of foresight is the essence of financial intelligence.

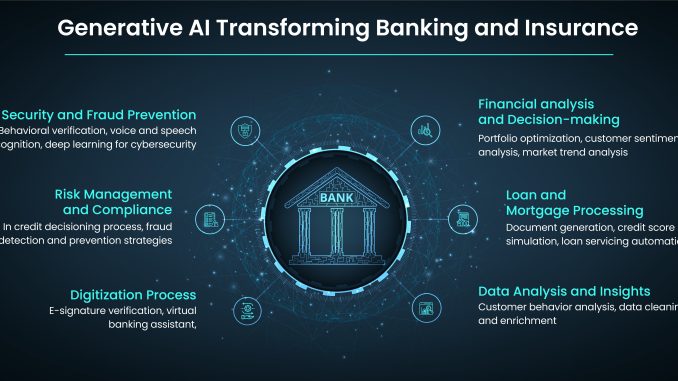

Technology is enhancing this dynamic by making insurance more accessible, transparent, and personalized. Digital platforms allow users to compare policies, track coverage, and receive tailored recommendations. This empowers consumers to make informed choices and engage more actively with their financial protection. It also supports financial education, helping users understand the nuances of coverage, claims, and benefits. As a result, insurance is becoming less of a mystery and more of a strategic tool. When people understand what they’re buying and why it matters, they’re more likely to see insurance as an integral part of their financial life.

Ultimately, insurance is a reflection of how we think about risk, responsibility, and resilience. It’s a signal that we’re not just reacting to life’s uncertainties, but preparing for them with intention. It’s a way of saying, “I’ve considered the possibilities, and I’ve made choices that protect my future.” That mindset is at the heart of financial intelligence. It’s not just about numbers—it’s about values, priorities, and the ability to navigate complexity with clarity. When insurance is understood and used strategically, it becomes more than a policy—it becomes a statement of wisdom.

Sources: [WallStreetMojo on financial intelligence](https://www.wallstreetmojo.com/financial-intelligence/), [EY on finance in insurance](https://www.ey.com/content/dam/ey-unified-site/ey-com/en-gl/industries/insurance/documents/ey-finance-in-insurance-reimagined-the-why-what-and-how-of-transformation-v2.pdf), [McKinsey on insurance industry transformation](https://www.mckinsey.com/industries/financial-services/our-insights/the-future-of-ai-in-the-insurance-industry).